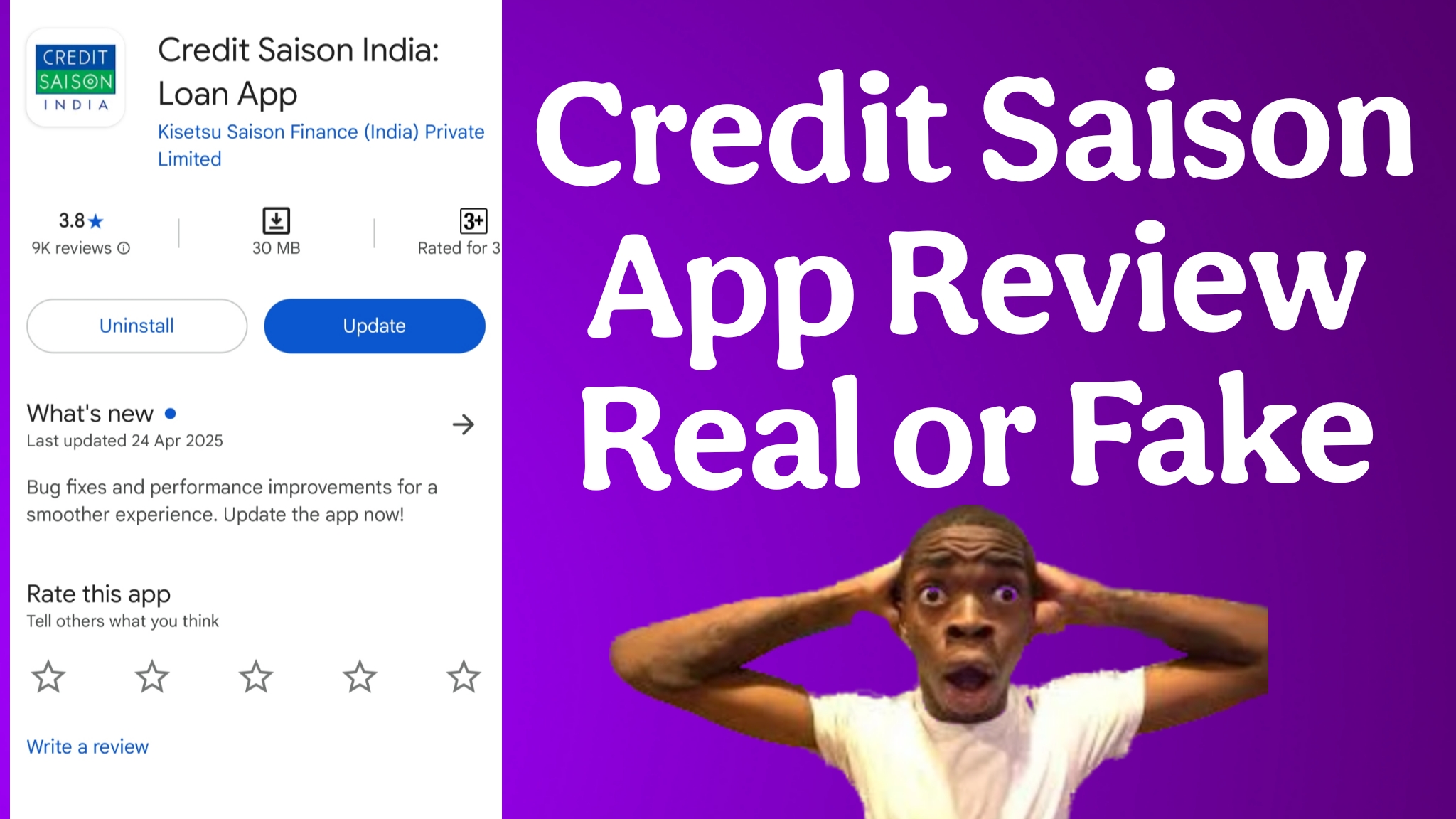

Credit Saison India Loan App Review: A Fresh Take on Borrowing in 2025

Looking for a loan app that promises to be your “partner in financial success”? Credit Saison India – Loan App claims to deliver just that, with offerings for both personal and business needs. As someone who’s explored this app inside out, I’m here to share my experience in a way that feels real, relatable, and straight from the heart—because let’s face it, choosing a loan app is a big deal! This review dives into the app’s features, my personal take, and some customer feedback to give you a clear picture. Plus, it’s written to help you find this app easily on search engines, so let’s get started.

What is Credit Saison India – Loan App?

Credit Saison India, owned by Kisetsu Saison Finance (India) Private Limited, is an RBI-registered NBFC with a AAA rating from CRISIL and CARE. That’s a solid stamp of credibility right there! The app offers instant personal loans (₹20,000 to ₹5,00,000) and business loans (up to ₹15,00,000), with flexible repayment options and transparent costs. Whether you’re planning a wedding, renovating your home, expanding your business, or managing cash flow, this app aims to be your go-to financial buddy.

The Play Store description highlights:

- Flexible Access to Funds: Quick loans for personal and business goals.

- Transparent Costs: No hidden charges—what you see is what you pay.

- Flexible EMI Options: Repayment plans tailored to your budget.

- Free Credit Reports: A neat perk for customers to track their credit health.

Sounds promising, right? But how does it hold up in real life? Let’s break it down.

My Experience with Credit Saison India – Loan App

I decided to test the waters with a personal loan to cover some home renovation costs. The app’s interface is clean and straightforward—none of that cluttered nonsense you find in some loan apps. Signing up was a breeze; I gave consent for the app to read my financial SMSs (standard for credit profiling), and within minutes, I had a loan offer tailored to my needs.

I applied for a ₹2,00,000 loan with a 12-month tenure. Here’s how it worked out:

- Loan Amount: ₹2,00,000

- Interest Rate: 12% p.a. (within their 9.99%–29.99% range)

- Processing Fee: ₹4,720 (2.5% + GST)

- Net Disbursed: ₹1,95,280

- Total Repayment: ₹2,13,796

- Monthly EMI: ~₹17,816

The funds hit my account within 24 hours, which was a lifesaver since I needed to pay my contractor ASAP. The EMI schedule was flexible, letting me choose a date that synced with my salary cycle. Plus, the free credit report feature was a nice touch—I could see where my credit score stood without paying extra.

But it wasn’t all smooth sailing. The app’s payment system felt a bit rigid. I tried paying my EMI a day early to avoid any hiccups, but the option wasn’t available until the due date. This felt odd, especially since some reviews (more on that later) mentioned extra charges for late payments. Thankfully, I didn’t face any penalties, but it’s something to watch out for.

The Good Stuff

Here’s what I genuinely liked about Credit Saison India:

- Speedy Process: From application to disbursal, everything was lightning-fast. Perfect for urgent needs like medical expenses or business cash flow.

- Transparency: The app lays out all costs upfront—interest, processing fees, and even potential add-ons like insurance or document charges. No nasty surprises!

- Flexible Loans: Whether you need ₹20,000 for a quick trip or ₹15,00,000 for business expansion, there’s something for everyone.

- Reputable Backing: Being RBI-registered and AAA-rated gives peace of mind that this isn’t some fly-by-night operation.

The Not-So-Great Stuff

No app is perfect, and Credit Saison India has its quirks:

- Payment Restrictions: The inability to pay EMIs early or manually on the due date feels like a design flaw. It could lead to accidental delays and penalties (like the ₹450 NACH bounce charge).

- Customer Support: I reached out to their team (via 18001038961) with a query about EMI rescheduling. The response was polite but slow—took two days for a reply. In a pinch, that’s frustrating.

- Additional Charges: The foreclosure charge (up to 5% + GST) and penal charges (3% per month on overdue amounts) can add up if you’re not careful.

What Other Users Are Saying

To give you a balanced view, I checked out some recent customer reviews from the Play Store. Here’s the vibe:

- Deepak Varma (04/04/25): Gave a 1-star rating, calling out “worst customer service” and unexpected cheque bounce charges despite issues on the app’s end. He advised looking for other loan apps.

- Soham Chilekar (01/03/25): Another 1-star review, slamming the “third-class service” and glitchy app performance. He felt the customer service team lacked basic knowledge.

- Nandan Singh (04/04/25): Complained about poor customer service and the app’s tendency to disable manual EMI payments until after the due date, leading to extra interest and penalties.

- Pillspearll (04/04/25): Called the app’s practices “shady,” pointing out issues with EMI payments being blocked until late, resulting in additional charges.

Ouch—these reviews paint a grim picture of customer service and app functionality. However, the company responded to each complaint, asking for more details to resolve the issues. That’s a sign they’re at least trying to address feedback, but it seems like execution is hit-or-miss.

Tips for Using Credit Saison India – Loan App

Based on my experience and user feedback, here’s how to make the most of this app:

- Double-Check EMI Dates: Set reminders to pay on time since manual payments can be tricky. Avoid bounce charges (₹450–₹500) by ensuring your account has funds.

- Read the Fine Print: Understand all charges—processing fees (up to 3% + GST), foreclosure costs, and penal charges—before signing up.

- Contact Support Early: If you face issues, reach out via email (support@creditsaison-in.com) or phone (18001038961) well in advance. Patience is key!

- Use the Credit Report: Take advantage of the free credit report to monitor your score and improve your loan eligibility.

Is Credit Saison India Worth It?

Credit Saison India – Loan App is a solid choice if you need quick funds with clear terms and don’t mind a few app quirks. It’s backed by a reputable NBFC, offers flexible loans, and delivers funds fast—perfect for emergencies or business growth. However, the payment system and customer service need work, as echoed by several users. If you’re diligent about EMI payments and okay with occasional delays in support, this app can be a reliable partner.

My Rating: ★★★☆☆ (3/5)

It’s not perfect, but it gets the job done for urgent financial needs. Just stay on执

For more details, check out their website: privo.in or creditsaison.in

Have you used Credit Saison India? Share your thoughts below—I’d love to hear your experience!