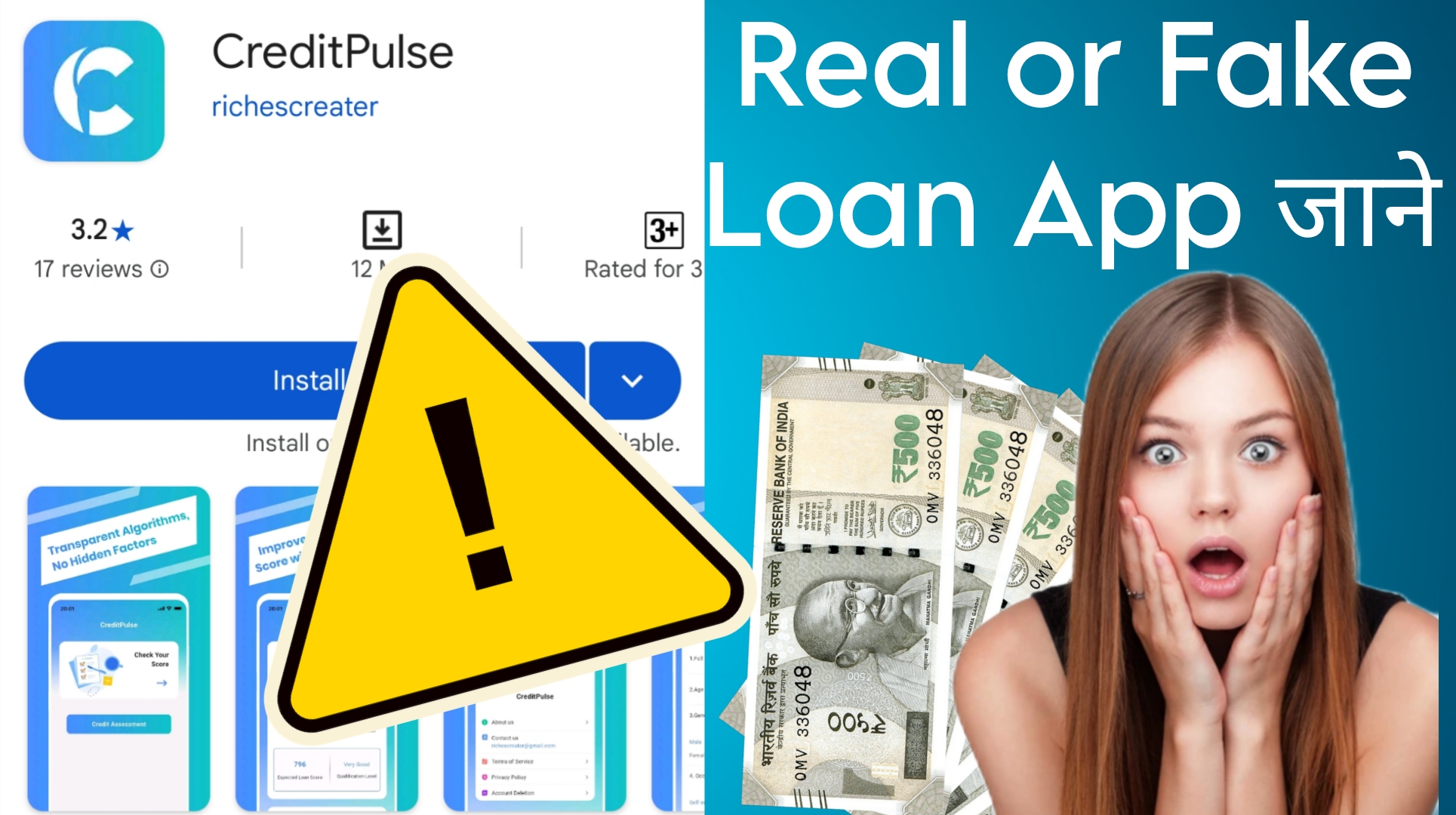

CreditPulse Loan App Review: Exposed A Fake Chinese Loan App

In the rapidly growing world of digital lending, apps like CreditPulse promise quick financial solutions and credit management tools. Marketed as “India’s premier Android credit scoring app,” CreditPulse claims to offer personalized credit scores, military-grade security, and transparent analytics. However, a closer look reveals a troubling reality: CreditPulse is an unapproved, potentially fraudulent Chinese loan app that exploits vulnerable users with predatory practices. This article uncovers the truth behind CreditPulse, its deceptive tactics, and why it should be avoided at all costs.

What is CreditPulse Loan App?

CreditPulse presents itself as a legitimate financial tool designed to help users “master their credit” and “simplify financial decisions.” Its Google Play Store description boasts features like:

- Credit Assessment: Personalized credit scores based on income, occupation, and financial behavior.

- Military-Grade Security: Localized data storage and AES-256 encryption.

- Smart Analytics: Interactive dashboards and real-time fraud detection.

- Privacy First: Compliance with India’s DPDP Act (2023) and no requirement for sensitive financial details.

- Instant Results: Credit reports generated in just 10 minutes with minimal documentation.

At first glance, these features seem appealing, especially for individuals seeking quick credit solutions. However, CreditPulse is neither approved by the Reserve Bank of India (RBI) nor registered with any Non-Banking Financial Company (NBFC), raising serious red flags about its legitimacy.

The Dark Truth Behind CreditPulse

Despite its polished marketing, CreditPulse operates as a predatory 7-day loan app, a model commonly associated with illegal Chinese lending apps. These apps exploit users with exorbitant interest rates, hidden fees, and aggressive recovery tactics. Here’s how CreditPulse deceives its users:

1. Predatory Loan Terms

User reviews on the Google Play Store paint a grim picture of CreditPulse’s lending practices. For instance, Akash Kapil shared his experience on May 14, 2025, warning others:

“Please guys, I warn you all don’t ever try to take a loan from this application. They are giving 1,200 rs only with 800 rs processing fees and just for 7 days. After 7 days, I have to give 2,000 rs. God, they are looting the people, and keep in mind guys my CIBIL score is more than 750.”

This review highlights the app’s outrageous terms: a loan of ₹1,200 comes with a ₹800 processing fee, and the borrower must repay ₹2,000 within just 7 days. This translates to an astronomical interest rate, far exceeding ethical lending standards. Such practices are designed to trap users in a cycle of debt, a hallmark of illegal loan apps.

2. Unapproved and Unregulated

CreditPulse operates without RBI approval or NBFC registration, violating India’s digital lending regulations. The RBI has repeatedly cracked down on illegal lending apps, noting that over 600 such apps were identified as fraudulent, with 27 blocked by the government as of May 2022. CreditPulse’s lack of regulatory oversight means it operates outside the law, leaving users with no recourse in case of disputes.

3. Data Privacy Concerns

While CreditPulse claims to prioritize privacy with “localized storage” and “end-to-end encryption,” user reviews suggest otherwise. Satheesh P, in a review dated May 12, 2025, stated:

“Fake app just getting our information only.”

Many illegal Chinese loan apps are notorious for harvesting personal data, including contact lists, photos, and financial details, which are then used for blackmail and harassment. CreditPulse’s vague privacy policy and lack of regulatory compliance raise serious concerns about how it handles sensitive user information.

4. Aggressive Recovery Tactics

Illegal loan apps often resort to harassment, threats, and shaming to recover loans. Sk Sahawaz Ahmed’s review on May 14, 2025, labeled CreditPulse a “fake Chinese loan app” and called for its removal from the Play Store. Such apps are known to access users’ contact lists and threaten to shame borrowers by messaging their friends and family. This predatory behavior not only violates ethical standards but also causes significant emotional distress.

5. Deceptive Marketing

CreditPulse’s description on the Play Store is carefully crafted to appear legitimate, using buzzwords like “military-grade security,” “explainable AI,” and “DPDP Act compliance.” However, these claims are misleading. The app’s email address, richescreater@gmail.com, is unprofessional and raises doubts about its credibility. Furthermore, its promise of instant credit reports without documentation is a common tactic used by scam apps to lure users.

The Bigger Picture: Chinese Loan Apps in India

CreditPulse is not an isolated case. Illegal Chinese loan apps have been a growing menace in India, exploiting regulatory loopholes to target vulnerable borrowers. According to a 2023 Al Jazeera report, these apps harass borrowers by accessing their contacts and using threats and blackmail. The Enforcement Directorate (ED) has also uncovered Chinese-controlled fintech companies misusing RBI guidelines to perpetrate scams.

In response, the RBI has taken steps to curb this issue, including creating a public repository of authorized digital lending apps in August 2024. However, apps like CreditPulse continue to slip through the cracks, highlighting the need for greater vigilance.

Why You Should Avoid CreditPulse

Based on user reviews and its lack of regulatory approval, CreditPulse is a dangerous app that preys on unsuspecting users. Here are key reasons to steer clear:

- Exorbitant Fees and Interest Rates: High processing fees and short repayment periods make it impossible for users to repay without falling into debt.

- Data Theft Risks: The app may collect and misuse personal information, putting users at risk of harassment and fraud.

- No Legal Recourse: As an unapproved app, users have no protection if things go wrong.

- Harassment Tactics: Borrowers may face threats and shaming if they fail to repay on time.

Safer Alternatives to CreditPulse

Instead of risking your financial security with CreditPulse, consider legitimate lending apps that are RBI-approved or NBFC-registered. Akash Kapil’s review recommends apps like mPokket, Branch, or Buddy Loan, which offer fairer terms and transparency. Always verify an app’s credentials before downloading, and check for RBI or NBFC registration.

How to Protect Yourself from Fake Loan Apps

To avoid falling victim to apps like CreditPulse, follow these tips:

- Check Regulatory Approval: Ensure the app is registered with an NBFC or approved by the RBI. The RBI’s planned repository of authorized apps can help.

- Read Reviews Carefully: Look for patterns in user feedback, especially complaints about fees, harassment, or data misuse.

- Avoid Apps with Suspicious Terms: Be wary of apps offering loans without credit checks or demanding high processing fees.

- Protect Your Data: Never share sensitive information like bank details or contact lists with unverified apps.

- Report Fraudulent Apps: If you encounter a scam app, report it to Google Play Store or the RBI to protect others.

Conclusion: Stay Away from CreditPulse

CreditPulse may market itself as a trustworthy credit management tool, but its predatory practices, lack of regulatory approval, and user complaints expose it as a fake Chinese loan app. With exorbitant fees, potential data theft, and aggressive recovery tactics, CreditPulse is a financial trap that users must avoid. Opt for legitimate, RBI-approved alternatives and stay vigilant to protect your financial security.

If you’ve encountered CreditPulse or similar apps, share your experience with the authorities and warn others. Together, we can expose and eliminate these fraudulent apps from the digital lending space.