Hope Loan App Review 2025: Is It a Legitimate 15-Day Loan Solution or a Scam?

In the fast-paced digital lending landscape of India, instant personal loan apps have become a go-to solution for many seeking quick financial assistance. Among these, the Hope Fund Loan App has gained attention for its promise of seamless, secure, and rapid loan disbursal through its partnership with an RBI-registered NBFC. Available on the Google Play Store, Hope Fund markets itself as a trusted assistant for personal finance, offering loans ranging from ₹5,000 to ₹80,000 with tenures of 3 to 12 months. However, while the app’s Play Store description paints an appealing picture, user reviews tell a different story, raising concerns about transparency, hidden charges, and potential scams.

Understanding Hope Fund Loan App: Play Store Description Breakdown

The Hope Fund Loan App, developed by CASH FOR GOLD PRIVATE LIMITED, positions itself as a user-friendly platform for personal loans, emphasizing convenience, security, and accessibility. Below is a detailed look at the key aspects of its Play Store description:

Key Features Highlighted in the Description

- RBI-Authorized Partnership: Hope Fund collaborates with VAISHALI SECURITIES LIMITED, an RBI-registered NBFC (RBI Registration No.: 01.00188, CIN: U65923GJ1995PLC026569). This partnership is a significant selling point, as it suggests regulatory oversight and legitimacy.

- Loan Details:

- Amount: ₹5,000 to ₹80,000

- Tenure: 3 to 12 months

- Interest Rate: 0.05% per day

- APR Range: 0% to 18.25%, depending on the borrower’s risk profile

- Example Loan Calculation: For a ₹50,000 loan for 4 months at 0.05% daily interest, the total interest is ₹3,000, making the repayment amount ₹53,000. The description notes that these figures are illustrative.

- Eligibility Criteria:

- Indian citizenship

- Age: 18 years and above

- Favorable credit history

- Valid Aadhaar and PAN cards

- Why Choose Hope Fund?:

- 24/7 accessibility

- Rapid loan approval within 30 minutes

- Minimal paperwork (Aadhaar, PAN, selfie)

- Nationwide reach

- No hidden costs or upfront fees

- How to Use the App:

- Download and sign up

- Verify identity

- Select loan type and submit details

- Await approval, accept the offer, and receive funds

- Repay on time to maintain financial health

- Contact Information:

- Email: hr@cashforgoldpvt.com

- Phone: +91 9611713129

- Address: WADHWA IIA – 12, LAJPAT NAGAR SOUTH, New Delhi – 110024, India

Initial Impressions of the Description

The Play Store description is professionally written, emphasizing trust, transparency, and ease of use. The mention of an RBI-registered NBFC partner, clear loan terms, and a straightforward application process aligns with what users expect from a legitimate loan app. The promise of no hidden costs and rapid approvals further enhances its appeal. However, the description’s claim of a 15-day loan option is not explicitly detailed, as the stated tenure range is 3 to 12 months. This discrepancy raises questions about whether the app truly offers short-term 15-day loans.

To get a clearer picture, let’s dive into user reviews and real-world experiences to see if Hope Fund lives up to its promises.

User Reviews: A Critical Look at Hope Fund’s Performance

While the Play Store description is promising, user feedback paints a starkly different picture. Below are summarized insights from recent reviews (as of April 2025) that highlight significant concerns:

Common Complaints from Users

- Hidden Charges and Reduced Disbursal Amounts:

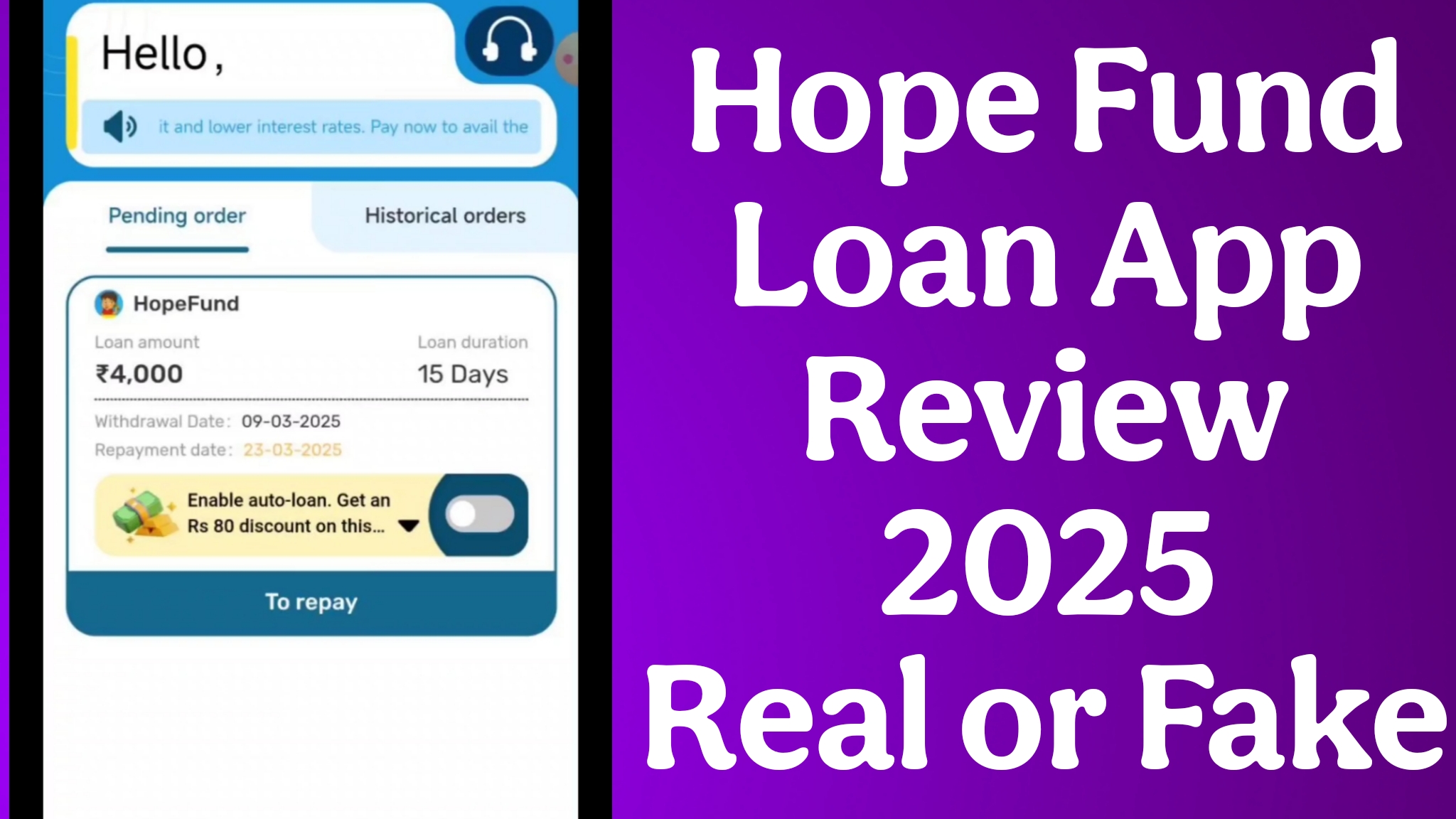

- Multiple users, including Sufi Rahat Malik, Mohan Krishna, and THARIF TA, reported receiving significantly less than the approved loan amount. For instance, a ₹4,000 loan resulted in only ₹2,800–₹2,960 credited to their accounts, yet they were required to repay ₹4,200–₹4,280 within 13–15 days.

- This suggests high processing fees or deductions not clearly disclosed upfront, contradicting the app’s claim of “no hidden costs.”

- Lack of Transparency:

- Users like Sufi Rahat Malik noted a lack of transparency, with EMI payments not updated and no clear communication about deductions. The grievance email (hr@cashforgoldpvt.com) was reported as non-functional, leaving users with no recourse for complaints.

- Unsolicited Loan Disbursals:

- Ansh sky shared a disturbing experience where the app disbursed ₹2,960 without explicit consent and demanded ₹4,200 in repayment. Even after repaying and logging out, the app allegedly sent another unsolicited loan, raising serious ethical concerns.

- High Interest Rates for Short-Term Loans:

- The repayment amounts cited (e.g., ₹4,200 for a ₹2,960 disbursal in 13 days) indicate exorbitant effective interest rates, far exceeding the advertised 0.05% daily rate (18.25% APR). This discrepancy suggests predatory lending practices.

- Technical Issues and Poor Customer Support:

- Selva Shanmugam labeled Hope Fund as a “number one cheating application,” citing issues with payment updates, lack of tenure extension options, and penalties disguised as interest. The absence of responsive customer support further frustrated users.

Positive Feedback

Interestingly, the provided reviews are overwhelmingly negative, with no positive feedback highlighted. This could indicate either a lack of satisfied users or selective reporting. However, the app’s Play Store rating and download metrics (not provided in the input) would offer additional context. The high number of “helpful” votes on negative reviews (e.g., 275 for Sufi Rahat Malik’s review) suggests widespread user dissatisfaction.

Developer Response

The only developer response came from CASH FOR GOLD PRIVATE LIMITED to THARIF TA’s review, apologizing for “confusion” and attributing the reduced disbursal to “applicable processing fees.” However, the response lacks specificity and fails to address the core issue of transparency, further eroding trust.

Critical Analysis: Is Hope Fund Legitimate or a Scam?

To determine whether Hope Fund is a reliable 15-day loan app, let’s evaluate its legitimacy, features, and red flags based on the description and user feedback.

Legitimacy Check

- RBI-Registered NBFC Partnership:

- The app’s partnership with VAISHALI SECURITIES LIMITED, an RBI-registered NBFC, is a strong indicator of legitimacy. NBFCs are regulated by the RBI, ensuring compliance with fair lending practices and data privacy standards.

- However, the app itself is not directly regulated by the RBI, as digital lending platforms act as facilitators for NBFCs. This distinction means that while the NBFC may be legitimate, the app’s operational practices could still be questionable.

- Contact Information and Transparency:

- The provision of a physical address, phone number, and email aligns with RBI guidelines for legitimate loan apps. However, user reports of a non-functional email and unresponsive support undermine this credibility.

- The website for VAISHALI SECURITIES LIMITED (https://www.vaishalisecuritiesltd.com/) could provide further verification, but its functionality and content were not assessed in this review.

- Play Store Presence:

- Being available on the Google Play Store adds a layer of credibility, as Google has tightened regulations for financial apps. However, user reviews indicate that presence on the Play Store does not guarantee ethical practices.

Red Flags

- Discrepancy in Loan Tenure:

- The description mentions 3–12-month tenures, but user reviews focus on 15-day loans, suggesting either misleading marketing or unadvertised short-term loan products. This lack of clarity is a significant concern.

- High Effective Interest Rates:

- The advertised 0.05% daily interest (18.25% APR) appears reasonable for an NBFC loan. However, user experiences (e.g., ₹4,200 repayment for ₹2,960 in 13 days) imply an effective interest rate of over 40% for short-term loans, which is predatory and potentially non-compliant with RBI guidelines.

- Unsolicited Loans:

- Disbursing loans without explicit user consent, as reported by Ansh sky, is a serious ethical violation and a hallmark of fraudulent apps. Such practices can trap users in debt cycles, a tactic often used by unregulated lenders.

- Hidden Fees and Deductions:

- The significant difference between approved and disbursed amounts (e.g., ₹4,000 approved vs. ₹2,960 received) indicates undisclosed processing fees. Legitimate apps must provide a Key Facts Statement (KFS) outlining all charges, as mandated by the RBI.

- Poor Customer Support:

- Non-functional grievance redressal mechanisms and unresponsive support violate RBI’s digital lending guidelines, which require accessible complaint portals.

Is It a Scam?

While Hope Fund is not an outright scam due to its NBFC partnership, its operational practices raise serious concerns. The combination of hidden fees, unsolicited loans, lack of transparency, and poor customer support aligns with characteristics of predatory lending apps. These issues suggest that Hope Fund may exploit regulatory loopholes, even if it operates under an RBI-registered NBFC.

Pros and Cons of Hope Fund Loan App

Pros

- RBI-Registered NBFC Partnership: Collaboration with VAISHALI SECURITIES LIMITED ensures regulatory oversight.

- Quick Approvals: 30-minute approval process is ideal for urgent needs.

- Minimal Documentation: Requires only Aadhaar, PAN, and a selfie, simplifying the process.

- Nationwide Accessibility: Available across India, enhancing reach.

- Play Store Availability: Indicates some level of vetting by Google.

Cons

- Hidden Charges: Significant deductions from disbursed amounts not disclosed upfront.

- High Effective Interest Rates: Short-term loans carry exorbitant rates, contradicting advertised APR.

- Unsolicited Loans: Disbursing funds without consent is unethical and risky.

- Poor Transparency: Lack of clear loan terms and non-functional grievance mechanisms.

- Negative User Feedback: Widespread complaints about scams and fraud.

How to Use Hope Fund Safely (If You Choose To)

If you decide to try Hope Fund despite the concerns, follow these precautions to minimize risks:

- Verify NBFC Details: Cross-check VAISHALI SECURITIES LIMITED’s registration on the RBI website (https://www.rbi.org.in).

- Read the Loan Agreement: Ensure you receive a Key Facts Statement (KFS) detailing all charges, interest rates, and repayment terms before accepting the loan.

- Avoid Auto-Debit Permissions: Be cautious about granting excessive app permissions or linking bank accounts until you’re certain of the app’s legitimacy.

- Monitor Disbursals: Immediately report unsolicited loans to the RBI or consumer protection agencies.

- Check Reviews Regularly: Stay updated on user feedback to identify new issues.

- Use Official Channels: Download the app only from the Google Play Store to avoid malware risks.

Alternatives to Hope Fund Loan App

Given the red flags, you may want to explore safer RBI-approved loan apps for 15-day or short-term loans. Here are some trusted alternatives based on recent data:

- KreditBee: Offers loans up to ₹5 lakh with quick approvals and transparent terms. Partners with RBI-registered NBFCs.

- PaySense: Provides instant loans from ₹5,000 to ₹5 lakh with a paperless process and competitive rates.

- Viva Money: Known for clear terms and 0% interest for up to 51 days, ideal for short-term needs.

- Navi: Offers loans up to ₹20 lakh with interest rates starting at 9.9% p.a. and a fully digital process.

- TrueBalance: Provides small loans up to ₹1.25 lakh with rapid disbursals and RBI-registered NBFC partnerships.

These apps have better user reviews and adhere more closely to RBI guidelines, making them safer choices for urgent financial needs.

Conclusion: Should You Use Hope Fund Loan App?

The Hope Fund Loan App presents itself as a promising solution for instant personal loans, backed by an RBI-registered NBFC and a user-friendly interface. However, critical user reviews reveal significant issues, including hidden charges, unsolicited loans, high effective interest rates, and poor customer support. While the app is not an outright scam, its predatory practices and lack of transparency make it a risky choice for a 15-day loan.

For those seeking quick, secure, and transparent lending solutions, alternatives like KreditBee, PaySense, or Viva Money are better options. Before using any loan app, always verify the NBFC’s RBI registration, read user reviews, and ensure clear loan terms to protect yourself from fraud.

If you’ve used Hope Fund or have questions about its legitimacy, share your experience in the comments below or contact the RBI’s consumer protection portal for assistance. Stay informed, borrow responsibly, and prioritize your financial safety in 2025.